"Unlock Your Financial Freedom with No Credit Check Payday Loan: Quick Cash Solutions for Everyone"

Guide or Summary:No Credit Check Payday Loan is a financial product designed for individuals who may have poor credit scores or no credit history at all. Th……

Guide or Summary:

#### Introduction to No Credit Check Payday Loan

No Credit Check Payday Loan is a financial product designed for individuals who may have poor credit scores or no credit history at all. This type of loan allows borrowers to access funds quickly without undergoing a traditional credit check, making it an appealing option for those in urgent need of cash.

#### Understanding the Concept

In today's fast-paced world, financial emergencies can arise unexpectedly. Whether it's a medical bill, car repair, or an unexpected expense, having quick access to cash can be a lifesaver. No Credit Check Payday Loan provides a solution for individuals who might otherwise be turned away by traditional lenders due to their credit history. These loans are typically short-term, designed to be repaid by the next payday, hence the name "payday loan."

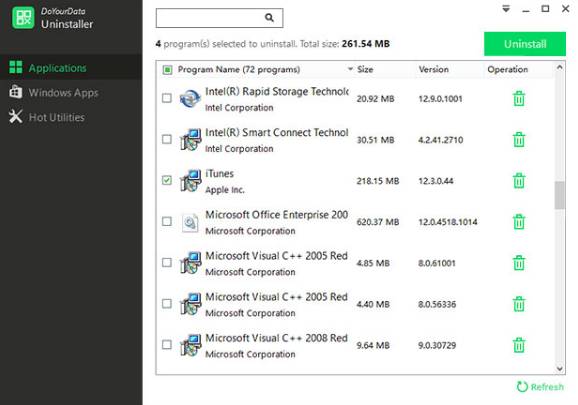

#### How It Works

The process for obtaining a No Credit Check Payday Loan is generally straightforward. Borrowers need to fill out an application, which often requires basic personal information, proof of income, and a bank account. Since lenders do not perform credit checks, approval rates are significantly higher compared to traditional loans.

Once approved, the funds can be deposited directly into the borrower's bank account, often within 24 hours. This quick turnaround can be crucial for those facing immediate financial challenges.

#### Pros and Cons

While No Credit Check Payday Loan offers many advantages, it's essential to consider both the pros and cons:

**Pros:**

- **Fast Approval:** The absence of a credit check speeds up the approval process.

- **Accessibility:** Ideal for individuals with poor credit or no credit history.

- **Convenience:** Funds are typically deposited directly into your bank account.

**Cons:**

- **High Interest Rates:** These loans often come with higher interest rates compared to traditional loans.

- **Short Repayment Terms:** Borrowers usually have to repay the loan quickly, which can lead to financial strain if not managed properly.

- **Potential for Debt Cycle:** If borrowers are unable to repay on time, they may resort to taking out additional loans, leading to a cycle of debt.

#### Responsible Borrowing

If you're considering a No Credit Check Payday Loan, it's crucial to borrow responsibly. Assess your financial situation and ensure that you can repay the loan by the due date. Creating a budget can help you manage your expenses and avoid falling into a debt trap.

#### Alternatives to Consider

While No Credit Check Payday Loan can be a quick fix, there are alternatives worth exploring:

- **Credit Unions:** Some credit unions offer small personal loans with lower interest rates.

- **Payment Plans:** Negotiating a payment plan with service providers can help manage unexpected expenses without resorting to high-interest loans.

- **Peer-to-Peer Lending:** Online platforms connect borrowers with individual lenders, often with more favorable terms.

#### Conclusion

In summary, No Credit Check Payday Loan can be a valuable resource for individuals facing financial emergencies, particularly those with limited credit options. However, it's essential to weigh the benefits against the potential risks and consider alternative solutions. By borrowing responsibly and planning for repayment, you can navigate your financial challenges more effectively and avoid the pitfalls associated with high-interest loans. Always remember to read the terms and conditions carefully and choose a reputable lender to ensure a positive borrowing experience.