Unlock Your Dream Ride: The Ultimate Auto Loan Car Finance Calculator Guide

#### What is an Auto Loan Car Finance Calculator?An **auto loan car finance calculator** is an essential tool for anyone looking to finance a vehicle. This……

#### What is an Auto Loan Car Finance Calculator?

An **auto loan car finance calculator** is an essential tool for anyone looking to finance a vehicle. This online calculator helps potential car buyers estimate their monthly payments based on various factors like the loan amount, interest rate, and loan term. By inputting these variables, users can gain insight into what they can afford and how different financing options impact their budget.

#### Why Use an Auto Loan Car Finance Calculator?

Using an **auto loan car finance calculator** can significantly simplify the car-buying process. Here are a few reasons why it's beneficial:

1. **Budgeting**: It allows you to set a realistic budget for your car purchase. By knowing your estimated monthly payments, you can avoid overspending and ensure that your new vehicle fits within your financial means.

2. **Comparing Offers**: With the calculator, you can easily compare different loan offers from various lenders. By adjusting the interest rates and terms, you can see how much you would save or spend over the life of the loan.

3. **Understanding Interest Rates**: The calculator helps you understand how interest rates affect your overall loan cost. A small change in the interest rate can lead to significant differences in your monthly payments and total repayment amount.

4. **Planning Ahead**: If you’re thinking about purchasing a car in the future, using the calculator can help you plan your finances. You can experiment with different scenarios to see how much you need to save for a down payment or how long you should wait to improve your credit score.

#### How to Use an Auto Loan Car Finance Calculator

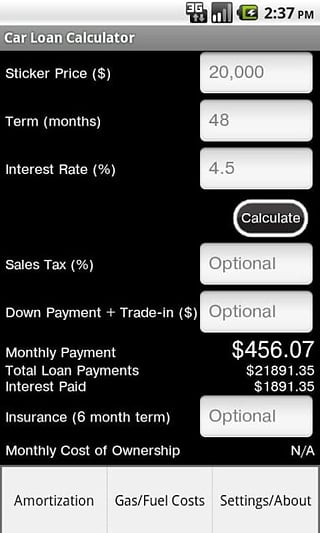

Using an **auto loan car finance calculator** is straightforward. Here’s a step-by-step guide:

1. **Enter the Loan Amount**: Start by inputting the total amount you wish to borrow. This typically includes the price of the car minus any down payment.

2. **Input the Interest Rate**: Enter the annual percentage rate (APR) offered by the lender. If you’re unsure of the rate, you can check average rates online or consult with lenders.

3. **Select the Loan Term**: Choose the duration of the loan, usually expressed in months (e.g., 36, 48, or 60 months). Longer terms may lower your monthly payments but can lead to higher overall interest costs.

4. **Calculate**: Click the calculate button to see your estimated monthly payment. The calculator will also provide you with the total interest paid over the life of the loan and the total repayment amount.

5. **Adjust Variables**: Experiment with different loan amounts, interest rates, and terms to find the best financing option for your situation.

#### Tips for Getting the Best Auto Loan

When using an **auto loan car finance calculator**, keep the following tips in mind to secure the best deal:

1. **Shop Around**: Don’t settle for the first loan offer you receive. Compare rates from multiple lenders, including banks, credit unions, and online lenders.

2. **Improve Your Credit Score**: A higher credit score can qualify you for lower interest rates. Before applying for a loan, check your credit report and address any issues.

3. **Consider a Larger Down Payment**: A larger down payment can reduce the amount you need to finance, leading to lower monthly payments and less interest paid over time.

4. **Negotiate**: Don’t hesitate to negotiate the terms of your loan with lenders. They may be willing to offer better rates or terms to secure your business.

5. **Read the Fine Print**: Always review the loan agreement carefully. Look for hidden fees, prepayment penalties, and other terms that may affect your overall cost.

#### Conclusion

An **auto loan car finance calculator** is a powerful tool that can help you navigate the complexities of car financing. By understanding how to use it effectively, you can make informed decisions that align with your financial goals. Whether you’re a first-time buyer or looking to upgrade your vehicle, leveraging this calculator can lead you to the best financing options available. Start your journey to car ownership today by utilizing this invaluable resource!