Understanding the Benefits and Repayment Options of Nelnet Federal Student Loan

#### Introduction to Nelnet Federal Student LoanNelnet Federal Student Loan is a crucial financial tool for many students pursuing higher education in the U……

#### Introduction to Nelnet Federal Student Loan

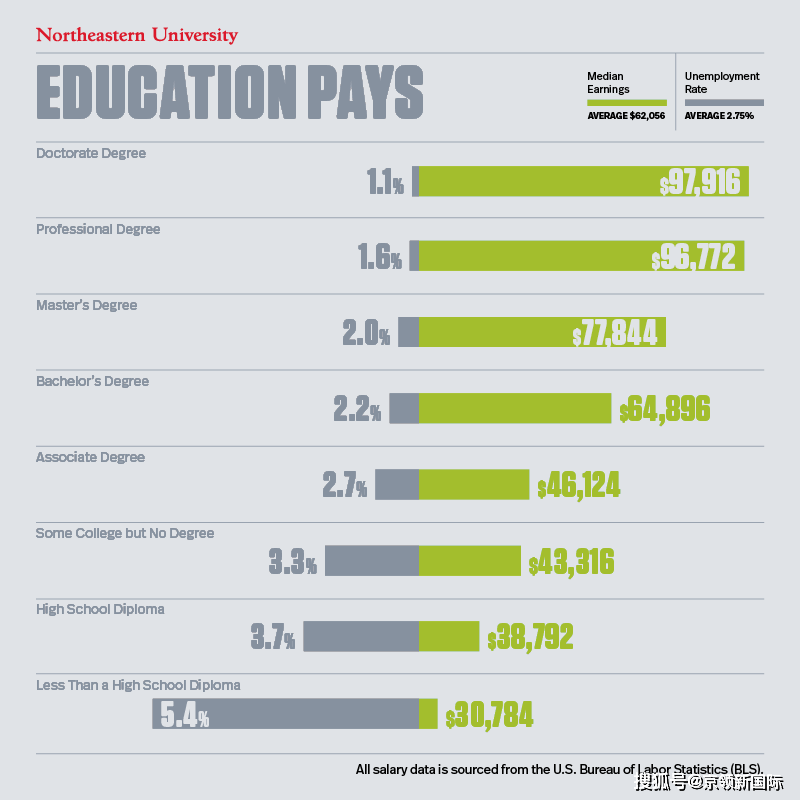

Nelnet Federal Student Loan is a crucial financial tool for many students pursuing higher education in the United States. This loan program is designed to help students cover their tuition fees, living expenses, and other educational costs. Understanding the intricacies of Nelnet Federal Student Loan is essential for students and their families to make informed decisions about financing their education.

#### The Application Process for Nelnet Federal Student Loan

Applying for a Nelnet Federal Student Loan is a straightforward process. Students must first complete the Free Application for Federal Student Aid (FAFSA). This application determines eligibility for federal financial aid, including loans. Once the FAFSA is processed, students will receive a financial aid offer from their chosen institution, which may include the Nelnet Federal Student Loan as part of their funding package.

#### Types of Nelnet Federal Student Loans

There are several types of federal student loans available through Nelnet, including:

- **Direct Subsidized Loans**: These loans are available to undergraduate students with demonstrated financial need. The government pays the interest while the student is in school at least half-time.

- **Direct Unsubsidized Loans**: These loans are available to both undergraduate and graduate students and do not require proof of financial need. Interest accrues while the student is in school.

- **Direct PLUS Loans**: These loans are available to graduate students and parents of dependent undergraduate students. They require a credit check and are used to cover any remaining education costs after other financial aid is applied.

#### Benefits of Nelnet Federal Student Loans

One of the primary advantages of Nelnet Federal Student Loans is their flexible repayment options. Borrowers can choose from several repayment plans, including:

- **Standard Repayment Plan**: Fixed monthly payments over a period of 10 years.

- **Graduated Repayment Plan**: Payments start lower and gradually increase every two years, suitable for those expecting their income to rise.

- **Income-Driven Repayment Plans**: These plans adjust monthly payments based on the borrower’s income and family size, making them an excellent option for those with fluctuating earnings.

#### Loan Forgiveness Programs

Another significant benefit of Nelnet Federal Student Loans is the potential for loan forgiveness. Programs such as Public Service Loan Forgiveness (PSLF) allow borrowers who work in qualifying public service jobs to have their remaining loan balance forgiven after making 120 qualifying payments. This can be a game-changer for graduates entering public service fields.

#### Managing Your Nelnet Federal Student Loan

Once a student has taken out a Nelnet Federal Student Loan, it is crucial to manage it effectively. This includes staying informed about interest rates, understanding repayment terms, and keeping track of any changes in loan servicer policies. Nelnet provides various online tools and resources to help borrowers manage their loans, including budgeting calculators and repayment estimators.

#### Conclusion

In summary, the Nelnet Federal Student Loan program offers a vital resource for students seeking to finance their education. With a variety of loan types, flexible repayment options, and opportunities for loan forgiveness, it is essential for borrowers to understand their options and responsibilities. By staying informed and proactive in managing their loans, students can successfully navigate their financial journey through higher education.