Understanding the Federal Student Loan Interest Rate by Year: A Comprehensive Guide to Financing Your Education

#### IntroductionNavigating the complexities of student loans can be daunting, especially when it comes to understanding the **federal student loan interest……

#### Introduction

Navigating the complexities of student loans can be daunting, especially when it comes to understanding the **federal student loan interest rate by year**. This guide aims to shed light on how these rates have evolved over time and how they impact your financial planning for education.

#### What is the Federal Student Loan Interest Rate?

The **federal student loan interest rate by year** refers to the interest rates set by the federal government for various types of student loans, including Direct Subsidized Loans, Direct Unsubsidized Loans, and PLUS Loans. These rates are determined annually and can significantly affect the total cost of borrowing.

#### Historical Overview of Federal Student Loan Interest Rates

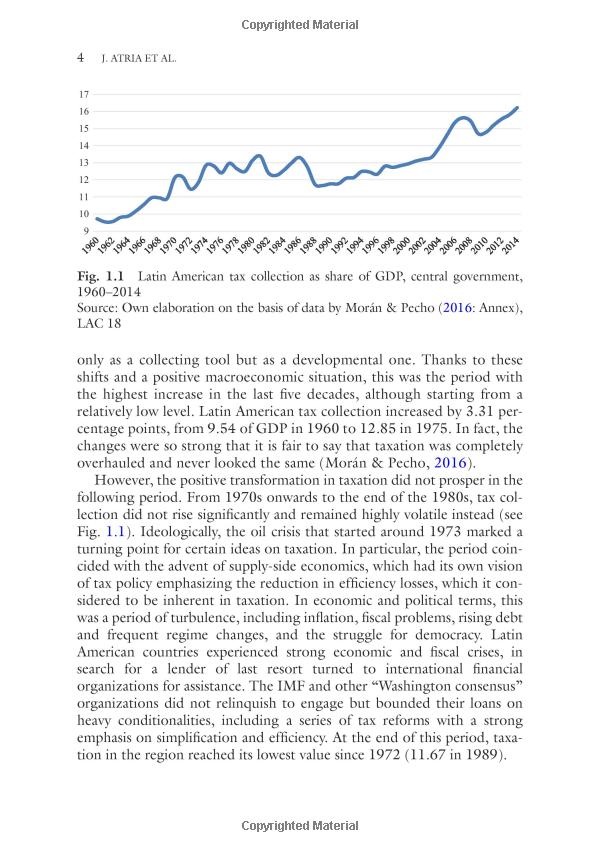

Understanding the historical trends in the **federal student loan interest rate by year** can help borrowers make informed decisions. For instance, in recent years, interest rates have fluctuated due to economic conditions, legislative changes, and federal policies.

- **2010-2012**: During this period, rates were relatively low, with Direct Subsidized and Unsubsidized Loans at around 3.4%. This was a favorable time for borrowers, as the government aimed to make education more accessible.

- **2013-2014**: A significant shift occurred when the Bipartisan Student Loan Certainty Act was enacted, tying interest rates to the financial markets. This change resulted in an increase, with rates rising to 5.4% for undergraduate loans.

- **2015-2021**: Rates continued to rise incrementally, peaking at 5.3% for undergraduate loans in 2021. This increase reflected broader economic trends and the need for the government to manage debt levels effectively.

#### Current Federal Student Loan Interest Rates

As of the most recent academic year, the **federal student loan interest rate by year** is crucial for prospective and current students. The rates are typically announced in the spring and are based on the 10-year Treasury note. For example, for the 2023-2024 academic year, the rates are set at 4.99% for undergraduate loans.

#### Impact of Interest Rates on Borrowers

The **federal student loan interest rate by year** directly affects how much students will pay over the life of their loans. Higher interest rates mean higher monthly payments and more interest accrued over time. For instance, a $30,000 loan at a 4.99% interest rate will cost significantly more than the same loan at a 3.4% rate over a standard repayment period.

#### Strategies to Manage Student Loan Interest

To mitigate the impact of the **federal student loan interest rate by year**, borrowers can consider several strategies:

1. **Loan Repayment Plans**: Explore different repayment plans, such as income-driven repayment, which can adjust your monthly payment based on your income.

2. **Loan Consolidation**: Consolidating loans can sometimes lower your interest rate, although this may not always be the case.

3. **Refinancing**: If you have good credit and stable income, refinancing your loans with a private lender may offer lower rates.

4. **Paying Down Principal Early**: Making extra payments towards the principal can reduce the total interest paid over the life of the loan.

#### Conclusion

Understanding the **federal student loan interest rate by year** is essential for anyone considering borrowing for their education. By staying informed about historical trends and current rates, students can better prepare for their financial future and make educated choices about their student loans. Always remember to consider your financial situation and explore all available options to manage your student debt effectively.