Understanding Car Loan Charts: Your Ultimate Guide to Financing Your Vehicle

#### Introduction to Car Loan ChartsA car loan chart is an essential tool for anyone looking to finance a vehicle. It provides a visual representation of va……

#### Introduction to Car Loan Charts

A car loan chart is an essential tool for anyone looking to finance a vehicle. It provides a visual representation of various loan options, interest rates, monthly payments, and terms. By utilizing a car loan chart, potential buyers can make informed decisions about their financing options, ensuring they choose the best loan for their financial situation.

#### Why Use a Car Loan Chart?

One of the primary reasons to use a car loan chart is to simplify the comparison process. With numerous lenders offering different rates and terms, it can be overwhelming to sift through all the information. A car loan chart consolidates this data, allowing you to quickly assess your options. By comparing different loans side by side, you can easily identify which offers the most favorable terms and interest rates.

#### Components of a Car Loan Chart

A comprehensive car loan chart typically includes several key components:

1. **Loan Amount**: The total amount you wish to borrow to purchase your vehicle.

2. **Interest Rate**: The percentage charged on the loan, which significantly impacts your monthly payments and total interest paid over the life of the loan.

3. **Loan Term**: The duration over which you will repay the loan, usually expressed in months (e.g., 36, 48, or 60 months).

4. **Monthly Payment**: The amount you will need to pay each month to repay the loan, which is calculated based on the loan amount, interest rate, and loan term.

5. **Total Interest Paid**: The total amount of interest you will pay over the life of the loan, which can help you understand the true cost of financing.

#### How to Read a Car Loan Chart

Reading a car loan chart is straightforward once you understand its components. Start by identifying the loan amount you need. Next, look at the interest rates offered by different lenders. Compare the monthly payments for various loan terms to see how they fit into your budget. Finally, consider the total interest paid to determine which loan option is the most cost-effective.

#### Using a Car Loan Chart to Make Informed Decisions

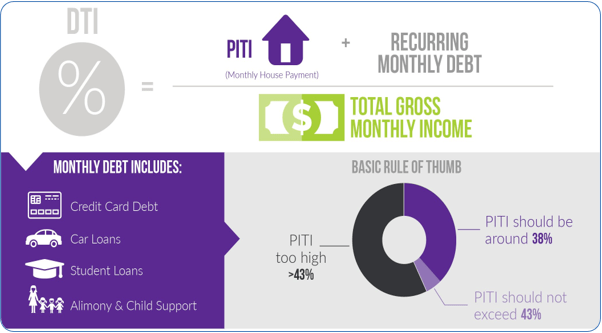

When you're ready to finance your vehicle, using a car loan chart can significantly impact your decision-making process. By visualizing your options, you can avoid common pitfalls, such as overextending your budget or choosing a loan with unfavorable terms. It's essential to consider your financial situation, including your credit score, income, and existing debts, when evaluating loan options.

#### Conclusion

In conclusion, a car loan chart is an invaluable resource for anyone looking to finance a vehicle. By providing a clear comparison of loan options, it enables you to make informed decisions that align with your financial goals. Whether you're a first-time buyer or looking to refinance, understanding how to use a car loan chart can help you secure the best financing terms available. Remember to take your time, do your research, and consult with financial advisors if needed. With the right information at your fingertips, you can confidently navigate the car loan landscape and drive away in your dream vehicle.