"Top FHA Mortgage Loan Lenders: Your Guide to Affordable Home Financing"

#### Understanding FHA Mortgage Loan LendersFHA mortgage loan lenders are financial institutions that offer loans insured by the Federal Housing Administrat……

#### Understanding FHA Mortgage Loan Lenders

FHA mortgage loan lenders are financial institutions that offer loans insured by the Federal Housing Administration (FHA). These lenders play a crucial role in helping first-time homebuyers and those with less-than-perfect credit secure financing for their homes. The FHA loan program is designed to make homeownership more accessible by providing lower down payment options and more flexible credit requirements.

#### Benefits of Choosing FHA Mortgage Loan Lenders

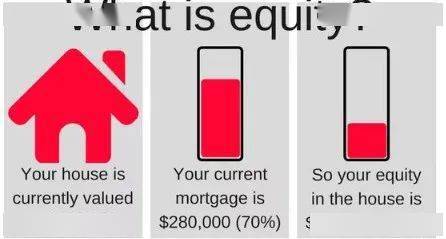

Choosing FHA mortgage loan lenders comes with several advantages. One of the most significant benefits is the lower down payment requirement, which can be as low as 3.5%. This feature is particularly beneficial for first-time homebuyers who may not have substantial savings. Additionally, FHA loans allow for higher debt-to-income ratios, making it easier for borrowers to qualify even if they have existing debts.

Another advantage is the leniency in credit score requirements. While conventional loans typically require a credit score of 620 or higher, FHA lenders may approve borrowers with scores as low as 580, or even lower in some cases with a larger down payment. This inclusivity opens the door for many individuals who might otherwise struggle to obtain financing.

#### How to Find the Right FHA Mortgage Loan Lenders

Finding the right FHA mortgage loan lenders involves research and comparison. Start by looking for lenders who specialize in FHA loans, as they will have a better understanding of the program and its requirements. Online reviews and ratings can provide insights into customer experiences and lender reliability.

It's also essential to compare interest rates and fees among different lenders. Even a small difference in interest rates can significantly impact the overall cost of the loan. Don’t hesitate to ask potential lenders about their experience with FHA loans and any specific programs they may offer.

#### Application Process with FHA Mortgage Loan Lenders

The application process with FHA mortgage loan lenders typically involves several steps. First, you will need to gather necessary documentation, including proof of income, employment history, and credit information. Once you have all the required documents, you can submit your application.

After submission, the lender will review your application, assess your financial situation, and determine your eligibility for an FHA loan. If approved, you will receive a loan estimate detailing the terms, interest rates, and closing costs. It’s crucial to review this document carefully and ask any questions before proceeding.

#### Conclusion: Making the Most of FHA Mortgage Loan Lenders

In conclusion, FHA mortgage loan lenders provide valuable services to those looking to purchase a home with more favorable financing options. By understanding the benefits, knowing how to find the right lenders, and navigating the application process, you can increase your chances of securing an FHA loan that meets your needs. Whether you are a first-time homebuyer or someone looking to refinance, exploring FHA mortgage loan lenders can be a smart step toward achieving your homeownership goals.