Collateral Loans: A Comprehensive Guide to Securing Your Finances

Guide or Summary:Understanding Collateral LoansTypes of Collateral LoansBenefits of Collateral LoansDrawbacks of Collateral LoansCollateral loans have emerg……

Guide or Summary:

- Understanding Collateral Loans

- Types of Collateral Loans

- Benefits of Collateral Loans

- Drawbacks of Collateral Loans

Collateral loans have emerged as a crucial tool in the world of personal finance, offering a lifeline to those seeking to secure a loan with less risk and more favorable terms. These loans are particularly appealing to individuals with limited credit histories or those looking to borrow against an asset they own. In this comprehensive guide, we'll delve into the intricacies of collateral loans, exploring how they work, the types of collateral that can be used, and the benefits and drawbacks associated with obtaining a collateral loan.

Understanding Collateral Loans

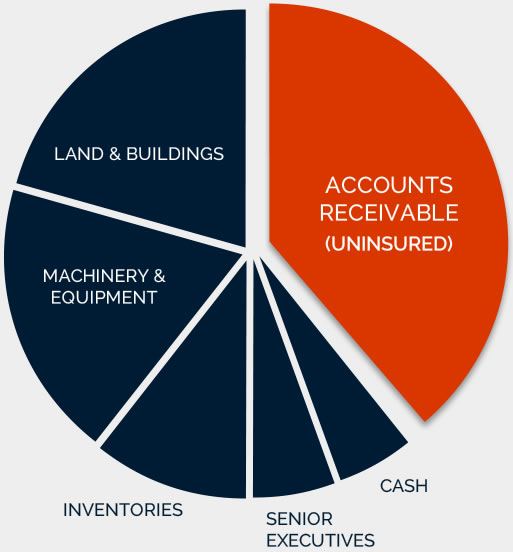

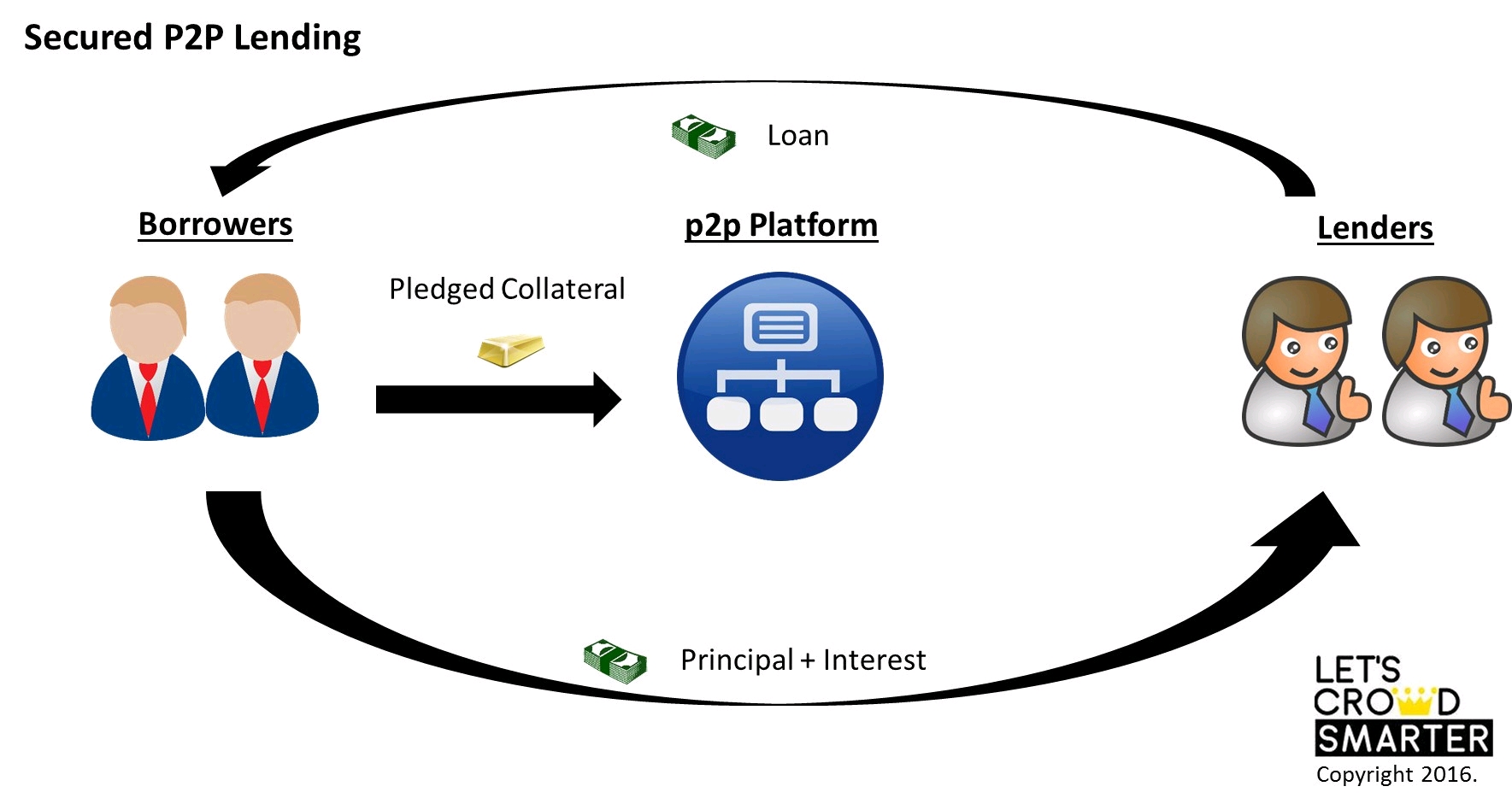

At its core, a collateral loan is a type of secured loan where the borrower pledges an asset as collateral. This asset serves as a guarantee that the lender will be repaid in the event the borrower defaults on the loan. Common collateral assets include vehicles, real estate, and personal property such as jewelry or electronics. The value of the collateral is used to determine the amount of the loan, with the lender typically advancing up to 70-80% of the collateral's value.

Types of Collateral Loans

There are several types of collateral loans, each with its own set of features and requirements. Here are some of the most common:

1. Auto Loans: These loans are secured by the borrower's vehicle, making them a popular choice for individuals looking to finance a new or used car. Auto loans can be obtained from banks, credit unions, or specialized auto lenders.

2. Home Equity Loans: These loans are secured by the equity in a borrower's home. Home equity loans can be used for a variety of purposes, including home improvements, debt consolidation, or even a vacation.

3. Personal Loans: Personal loans can be secured by various types of collateral, including vehicles, jewelry, or even collectibles. These loans are often used for personal expenses such as medical bills, education, or travel.

Benefits of Collateral Loans

One of the primary benefits of collateral loans is the reduced risk for lenders. By having an asset as collateral, lenders are more willing to lend money with favorable terms and interest rates. For borrowers, collateral loans offer a way to secure financing with less risk than unsecured loans, which often have higher interest rates and more stringent eligibility requirements.

Another benefit is the flexibility that collateral loans offer. Borrowers can use the funds for a variety of purposes, making these loans a versatile option for those in need of financing. Additionally, the ability to use an asset as collateral can make it easier for borrowers to obtain the funds they need, even if they have a limited credit history or poor credit score.

Drawbacks of Collateral Loans

While collateral loans offer many benefits, they also come with some drawbacks. One of the main risks associated with collateral loans is the possibility of losing the collateral if the borrower defaults on the loan. This can be particularly risky for high-value assets like real estate or vehicles, as the loss of these assets can have significant financial implications.

Another drawback is the potential for the collateral to lose value over time. If the value of the collateral falls below the amount of the loan, the borrower may be required to refinance the loan or find additional collateral to secure the remaining balance. This can be a significant financial burden and can make it difficult for borrowers to obtain the funds they need.

Collateral loans offer a flexible and secure way to obtain financing, making them a valuable tool for individuals looking to borrow money. By understanding the different types of collateral loans available and weighing the benefits and drawbacks, borrowers can make informed decisions about whether a collateral loan is the right choice for their financial situation. With careful consideration and planning, collateral loans can provide a reliable source of funding that helps individuals achieve their financial goals.