How Big Is Student Loan Debt in the United States?

Guide or Summary:Student Loan Debt StatisticsImpact on Borrowers and the EconomyPolicy and SolutionsStudent loan debt has become a significant concern for m……

Guide or Summary:

Student loan debt has become a significant concern for millions of Americans, with its magnitude impacting not only the financial futures of individual borrowers but also the broader economic landscape. The question of "How Big Is Student Loan Debt?" is not just a query about numbers; it is a reflection of the complex financial and educational pathways that many Americans navigate.

Student Loan Debt Statistics

As of recent data, student loan debt in the United States has reached staggering heights. According to the Federal Reserve, student loan balances have surpassed $1.7 trillion, making it the second-largest source of consumer debt after mortgages. This figure encompasses federal and private student loans, with an average student loan balance of approximately $32,000 per borrower.

Impact on Borrowers and the Economy

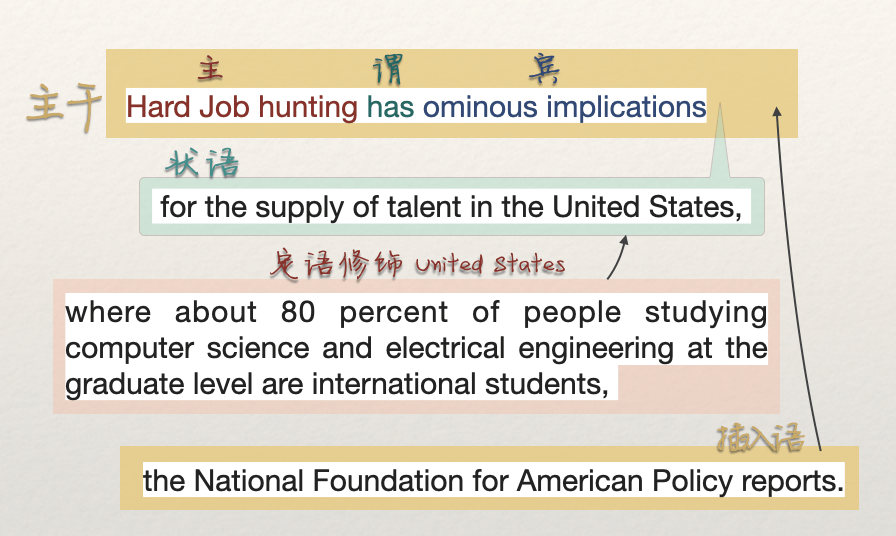

The sheer magnitude of student loan debt has far-reaching implications for both individual borrowers and the broader economy. For many, the weight of student loans can hinder their ability to purchase homes, start businesses, or even save for retirement. The high cost of education and subsequent debt can delay financial independence and contribute to a cycle of debt repayment that extends well into adulthood.

Economically, the high levels of student loan debt can have a dampening effect on consumer spending, which is a key driver of economic growth. When individuals allocate a significant portion of their income to student loan payments, they have less disposable income to spend on other goods and services. This can lead to reduced demand in various sectors, potentially stifling economic expansion.

Policy and Solutions

Addressing the enormity of student loan debt requires a multifaceted approach involving policy changes, educational reforms, and financial literacy initiatives. Policymakers have introduced various measures aimed at mitigating the burden of student loans, including income-driven repayment plans, loan forgiveness programs, and initiatives to make higher education more affordable.

One significant policy proposal is the cancellation or forgiveness of a portion of student loans for borrowers who work in public service or in fields critical to the nation's infrastructure and innovation. While such measures aim to provide relief to borrowers, they also face considerable debate and opposition, with concerns about their long-term fiscal sustainability.

In addition to policy solutions, there is a growing emphasis on the importance of financial literacy and early planning for higher education. Initiatives that encourage students to understand the true cost of college, explore alternative financing options, and plan for repayment are crucial in helping borrowers navigate the complex landscape of student loans.

The question of "How Big Is Student Loan Debt?" underscores the urgent need for a comprehensive approach to addressing this pressing issue. By understanding the magnitude of student loan debt and the far-reaching impacts it has on individuals and the economy, policymakers, educators, and financial advisors can work together to develop effective solutions. Whether through targeted policy changes, educational reforms, or financial literacy programs, the goal is to create a more sustainable and equitable system that enables all Americans to achieve their educational and financial aspirations.