No APR Personal Loan How to Get a No APR Personal Loan in the UK

Guide or Summary:Understanding the Benefits of No APR Personal LoansHow to Apply for a No APR Personal LoanConsiderations When Applying for a No APR Persona……

Guide or Summary:

- Understanding the Benefits of No APR Personal Loans

- How to Apply for a No APR Personal Loan

- Considerations When Applying for a No APR Personal Loan

In the world of personal finance, securing a loan is often a critical step for individuals looking to achieve their financial goals. Whether you need to fund a home improvement project, cover unexpected expenses, or simply manage your cash flow, a personal loan can provide the necessary funds. However, with the ever-changing landscape of financial services, it's essential to understand the various options available to you, including the no APR personal loan.

A no APR personal loan, also known as a zero percent APR personal loan, is a financial product that offers borrowers an interest rate of zero percent on their loan. This means that you won't have to pay any interest charges on the amount borrowed, making it an attractive option for those looking to minimize their financial obligations.

Understanding the Benefits of No APR Personal Loans

One of the primary benefits of a no APR personal loan is the reduced cost of borrowing. By eliminating the interest charges, you can significantly reduce the overall cost of the loan, which can be particularly beneficial for short-term borrowing needs. Additionally, a no APR personal loan can provide greater flexibility, allowing you to use the funds for a variety of purposes without incurring additional charges.

Another advantage of a no APR personal loan is the potential for lower monthly repayments. Since there are no interest charges, the amount you repay each month is generally lower than with a traditional personal loan. This can make it easier to manage your cash flow and budget for other financial obligations.

How to Apply for a No APR Personal Loan

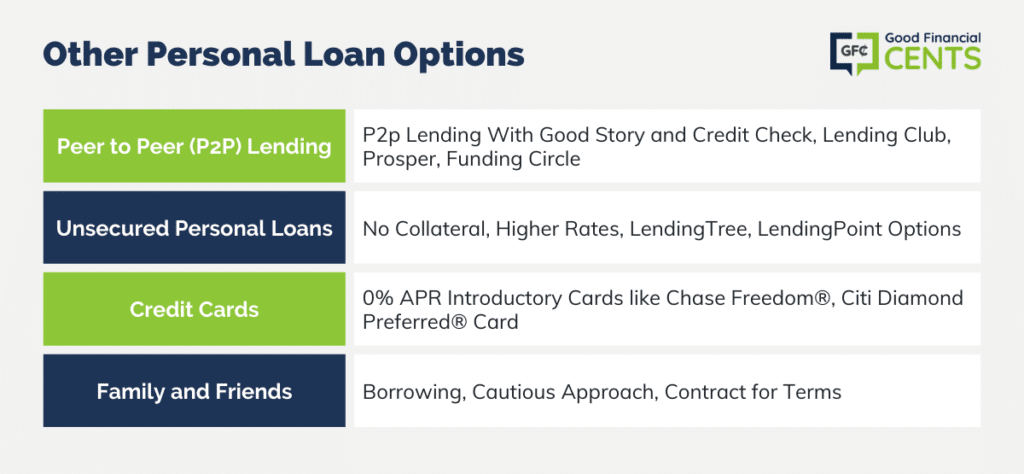

To apply for a no APR personal loan, you'll typically need to follow a few simple steps. Firstly, research potential lenders to find those that offer no APR personal loans. Look for lenders with a strong reputation and a range of loan options to suit your needs.

Once you've identified potential lenders, compare their terms and conditions to find the best deal. Pay close attention to the loan amount, repayment terms, and any fees associated with the loan.

When you've found a suitable lender, complete the application process. This may involve providing personal information, such as your income, employment status, and credit history. You may also need to provide documentation to verify your identity and financial situation.

Considerations When Applying for a No APR Personal Loan

While a no APR personal loan can be an attractive option, there are a few considerations to keep in mind. Firstly, it's important to ensure that you can repay the loan in full and on time. Failure to do so can result in late fees, penalties, and damage to your credit score.

Additionally, it's worth considering the potential drawbacks of a no APR personal loan. While the interest charges may be lower, you may still need to pay other fees, such as application fees or processing fees. These fees can add up over time and impact your overall cost of borrowing.

In conclusion, a no APR personal loan can be a valuable tool for managing your finances and achieving your financial goals. By understanding the benefits and considerations of this type of loan, you can make an informed decision about whether it's the right option for you. Remember to compare different lenders and their terms and conditions to find the best deal that meets your financial needs.