Save Loans: A Comprehensive Guide to Reducing Your Financial Burden

Guide or Summary:Saving Loans: An IntroductionThe Benefits of Saving LoansHow to Save Loans EffectivelyIn the modern era, the financial landscape is ever-ev……

Guide or Summary:

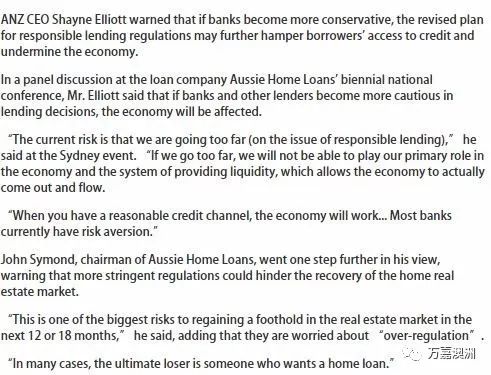

In the modern era, the financial landscape is ever-evolving, with new challenges and opportunities continually emerging. Among these, the concept of saving loans stands out as a pivotal strategy for managing personal finances effectively. This guide delves into the intricacies of saving loans, offering practical insights and actionable steps to help individuals reduce their financial burdens and achieve greater financial stability.

Saving Loans: An Introduction

At its core, a saving loan is a financial instrument that allows individuals to borrow money from a financial institution or other lender, with the intention of repaying the loan plus interest at a later date. This concept is rooted in the principle of deferred gratification, where the desire for immediate financial satisfaction is balanced against the long-term benefits of financial prudence.

The Benefits of Saving Loans

One of the primary advantages of saving loans is their flexibility. Unlike traditional loans, which often come with stringent terms and conditions, saving loans can be structured to suit the unique financial needs and circumstances of the borrower. This flexibility can be particularly beneficial for individuals who are looking to manage short-term financial obligations or who are seeking to build a financial safety net for the future.

Another significant benefit of saving loans is their accessibility. Many financial institutions offer a range of saving loan products, tailored to meet the diverse needs of borrowers. Whether you are looking to fund a major purchase, such as a home or vehicle, or you require additional liquidity to cover unexpected expenses, there is likely a saving loan option available that can help you achieve your financial goals.

How to Save Loans Effectively

To make the most of saving loans, it is essential to approach them with a clear understanding of your financial objectives and a strategic plan for repayment. Here are some key steps to follow when considering a saving loan:

1. **Assess Your Financial Situation**: Before applying for a saving loan, it is crucial to conduct a thorough assessment of your current financial situation. This includes evaluating your income, expenses, debts, and financial goals. Understanding your financial landscape will help you determine the right amount and type of saving loan to support your objectives.

2. **Research Your Options**: Once you have a clear picture of your financial situation, it's time to explore the various saving loan options available to you. Look for lenders that offer competitive interest rates, flexible repayment terms, and favorable conditions. Comparing different saving loan products can help you find the best option to meet your needs.

3. **Create a Repayment Plan**: With your saving loan in place, it is essential to develop a realistic repayment plan. This should include setting aside a specific amount each month to cover your loan payments, while also maintaining a buffer to cover unexpected expenses. Sticking to your repayment plan is crucial for avoiding financial strain and ensuring long-term financial stability.

4. **Monitor Your Progress**: Regularly reviewing your financial situation and the status of your saving loan is essential for staying on track. This includes monitoring your income, expenses, and debt levels, as well as tracking your repayment progress. Making adjustments to your financial plan as needed can help you stay on course and achieve your financial goals.

Saving loans offer a flexible and accessible solution for managing financial obligations and achieving long-term financial stability. By approaching saving loans with a clear understanding of your financial situation, researching your options, creating a realistic repayment plan, and monitoring your progress, you can make the most of this financial tool and achieve your financial objectives. Remember, the key to successful saving loans lies in careful planning and strategic decision-making. With the right approach, saving loans can be a powerful ally in your journey towards financial freedom and security.