1 School: Unlocking Financial Freedom Through Education Service

In recent years, the conversation surrounding student loan forgiveness has gained significant traction, particularly for those who choose to dedicate their……

In recent years, the conversation surrounding student loan forgiveness has gained significant traction, particularly for those who choose to dedicate their careers to teaching in Title 1 schools. These schools, often located in economically disadvantaged areas, serve a large number of students from low-income families. The U.S. Department of Education recognizes the importance of these educators and has developed programs designed to alleviate their student debt burdens. In this article, we will explore the various avenues of student loan forgiveness available for teachers working at Title 1 schools, the eligibility requirements, and the broader impact of such programs on the education system.

### Understanding Title 1 Schools

Title 1 schools receive federal funding under the Title I program of the Elementary and Secondary Education Act (ESEA). This funding aims to support schools with high percentages of children from low-income families, ensuring that all students have access to quality education. Teachers who work in these schools often face unique challenges, including limited resources, larger class sizes, and the need to address a wide range of socio-economic issues that affect their students' learning experiences.

### The Importance of Student Loan Forgiveness

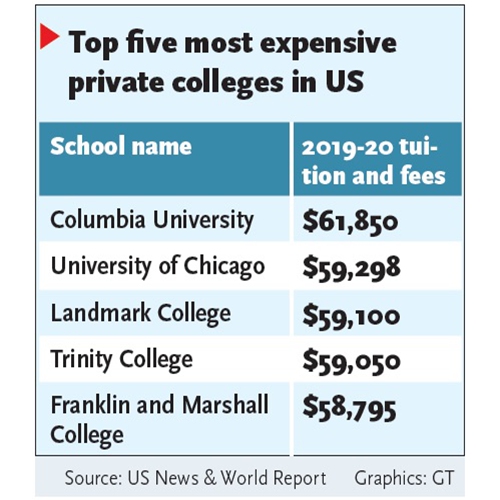

Student loan debt has reached staggering levels in the United States, with millions of graduates struggling to repay their loans. For educators, this burden can be even more pronounced, as many enter the profession with lower salaries compared to other fields. Student loan forgiveness programs serve as a vital lifeline, allowing teachers to focus on their passion for education without the overwhelming stress of financial obligations.

### Eligibility for Student Loan Forgiveness

To qualify for student loan forgiveness for working at a Title 1 school, educators must meet specific criteria. The most notable program is the Public Service Loan Forgiveness (PSLF) program, which forgives the remaining balance on Direct Loans after 120 qualifying monthly payments while working full-time for a qualifying employer. Title 1 schools generally qualify as eligible employers under this program.

Additionally, teachers may also explore the Teacher Loan Forgiveness program, which offers forgiveness of up to $17,500 on Direct Subsidized and Unsubsidized Loans after five consecutive years of teaching in a low-income school. To qualify, educators must be highly qualified and teach specific subjects such as mathematics, science, or special education.

### The Application Process

Applying for student loan forgiveness can be a complex process, but understanding the steps involved can help streamline the journey. Educators should start by ensuring they have the right type of loans, as not all federal loans qualify for forgiveness. Once confirmed, teachers can submit the necessary forms to their loan servicer, along with documentation proving their employment at a Title 1 school.

It's crucial for educators to keep meticulous records of their employment and payment history, as these documents will be required during the application process. Regularly checking in with their loan servicer can also provide updates on their progress toward forgiveness.

### The Broader Impact of Student Loan Forgiveness

Beyond the individual financial relief that student loan forgiveness offers, these programs have a broader impact on the education system. By incentivizing teachers to work in Title 1 schools, the government helps to attract and retain qualified educators in areas that desperately need them. This, in turn, contributes to a more equitable education system, as students in low-income areas benefit from experienced and dedicated teachers.

Moreover, student loan forgiveness for educators can lead to improved student outcomes. Research indicates that students perform better academically when taught by teachers who are committed to their profession and are not burdened by financial stress. By alleviating this stress, forgiveness programs can empower educators to focus on their teaching, innovate in their classrooms, and foster a positive learning environment.

### Conclusion

In conclusion, student loan forgiveness for working at a Title 1 school is not just a financial relief; it is a crucial investment in the future of education. By supporting teachers who dedicate their careers to serving underprivileged communities, these programs help create a more equitable education system while simultaneously addressing the growing student loan crisis. Educators should take advantage of these opportunities, ensuring they can continue to inspire and educate the next generation without the weight of student debt holding them back.