Accurate Car Loan Calculator: Your Ultimate Guide to Financing Your Dream Vehicle

When it comes to purchasing a vehicle, understanding your financing options is crucial. With the rise of online tools, an accurate car loan calculator has b……

When it comes to purchasing a vehicle, understanding your financing options is crucial. With the rise of online tools, an accurate car loan calculator has become an essential resource for prospective car buyers. This tool not only helps you estimate your monthly payments but also enables you to make informed decisions about your budget and overall car financing strategy. In this guide, we will explore the benefits of using an accurate car loan calculator, how it works, and tips for maximizing its utility to secure the best loan for your needs.

### Understanding the Importance of an Accurate Car Loan Calculator

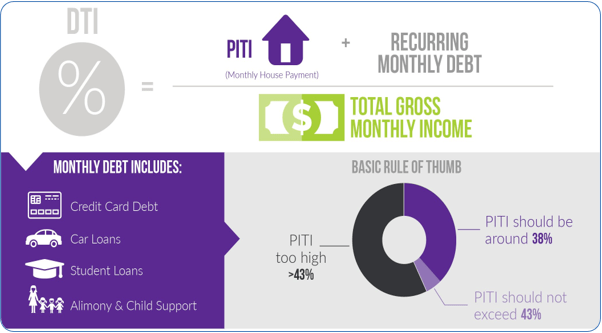

An accurate car loan calculator is designed to provide you with precise estimates based on the information you input. By entering details such as the vehicle price, down payment, loan term, and interest rate, you can quickly see how these factors influence your monthly payments. This tool is invaluable for budgeting, as it allows you to evaluate different financing scenarios and choose the one that fits your financial situation best.

### How an Accurate Car Loan Calculator Works

The functionality of an accurate car loan calculator is straightforward. Typically, you will need to provide the following inputs:

1. **Vehicle Price**: The total cost of the car you wish to purchase.

2. **Down Payment**: The amount of money you can afford to pay upfront, which reduces the overall loan amount.

3. **Loan Term**: The duration over which you plan to repay the loan, commonly ranging from 36 to 72 months.

4. **Interest Rate**: The annual percentage rate (APR) offered by the lender, which can vary based on your credit score and market conditions.

Once you input these details, the calculator will compute your estimated monthly payment, total interest paid over the life of the loan, and the total cost of the loan. This information can help you make more informed decisions when shopping for a car and comparing different financing options.

### Benefits of Using an Accurate Car Loan Calculator

1. **Budgeting**: Knowing your potential monthly payments allows you to create a realistic budget. You can determine how much you can afford without stretching your finances too thin.

2. **Comparative Analysis**: By adjusting variables such as down payment and loan term, you can see how different scenarios affect your payments. This feature is particularly useful when comparing offers from multiple lenders.

3. **Interest Rate Awareness**: An accurate car loan calculator can help you understand how even small changes in the interest rate can impact your overall loan cost. This insight can motivate you to shop around for better rates.

4. **Empowerment**: Armed with knowledge from the calculator, you can negotiate more effectively with dealerships and lenders. Understanding your financing options puts you in a better position to advocate for favorable terms.

### Tips for Maximizing Your Car Loan Calculator Experience

- **Research Rates**: Before using the calculator, research current interest rates. This will help you input a realistic figure and get a more accurate estimate of your payments.

- **Consider Total Costs**: While the monthly payment is important, also pay attention to the total cost of the loan. A lower monthly payment may come with a longer loan term, resulting in higher overall interest.

- **Experiment with Variables**: Don’t hesitate to play around with different down payment amounts and loan terms. This experimentation will give you a clearer picture of your options.

- **Check Your Credit Score**: Your credit score significantly impacts the interest rate you can secure. Knowing your score beforehand can help you estimate the rates you might qualify for.

- **Use Multiple Calculators**: Different calculators may have slight variations in their algorithms, so using multiple tools can provide a broader perspective on your financing options.

### Conclusion

In conclusion, an accurate car loan calculator is an indispensable tool for anyone looking to finance a vehicle. By providing precise estimates and insights into loan options, it empowers buyers to make informed decisions that align with their financial goals. Whether you are a first-time buyer or looking to upgrade your current vehicle, utilizing an accurate car loan calculator can streamline the car buying process and help you secure the best financing deal available. So, before you hit the dealership, take the time to explore this valuable resource and pave the way for a successful car purchase!