Understanding Payday Loans in Mobile, Mobile AL: Your Comprehensive Guide to Quick Cash Solutions

#### What are Payday Loans in Mobile, Mobile AL?Payday loans in Mobile, Mobile AL are short-term, high-interest loans designed to provide quick cash to indi……

#### What are Payday Loans in Mobile, Mobile AL?

Payday loans in Mobile, Mobile AL are short-term, high-interest loans designed to provide quick cash to individuals facing unexpected expenses. These loans are typically due on the borrower’s next payday, hence the name "payday loans." They are often sought by individuals who may not have access to traditional banking services or who need immediate funds for emergencies, such as medical bills or car repairs.

#### How Do Payday Loans Work?

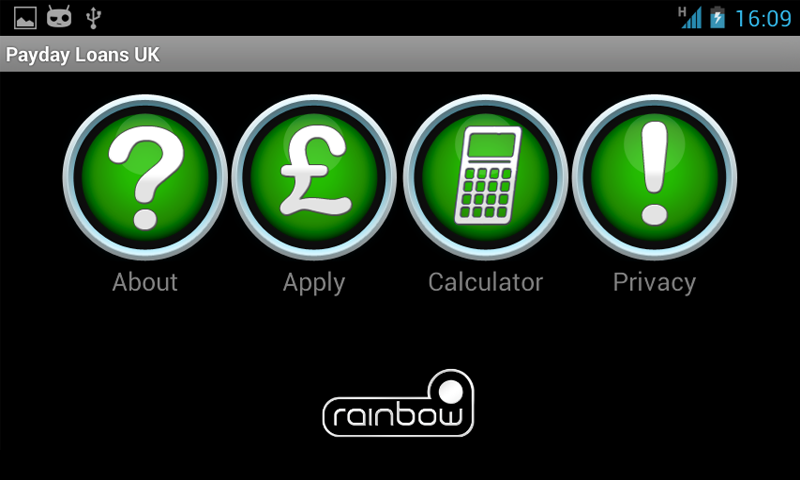

The process of obtaining payday loans in Mobile, Mobile AL is relatively straightforward. Borrowers can apply online or in person at various lending institutions. The requirements usually include proof of income, a valid ID, and an active checking account. The lender assesses the borrower’s financial situation and determines the loan amount, which can range from $100 to $1,000 or more, depending on state regulations.

Once approved, the borrower receives the funds quickly, often within 24 hours. However, it’s crucial to understand that these loans come with high-interest rates, sometimes exceeding 400% APR. This makes it essential for borrowers to have a repayment plan in place to avoid falling into a cycle of debt.

#### Pros and Cons of Payday Loans

Like any financial product, payday loans in Mobile, Mobile AL have their advantages and disadvantages.

**Pros:**

- **Quick Access to Cash:** The primary benefit is the speed at which funds are available, which can be crucial in emergencies.

- **Minimal Requirements:** Compared to traditional loans, payday loans often have fewer eligibility requirements, making them accessible to a broader range of borrowers.

- **No Credit Check:** Many lenders do not perform credit checks, allowing those with poor credit histories to secure funds.

**Cons:**

- **High Interest Rates:** The most significant drawback is the exorbitant interest rates, which can lead to serious financial strain if not managed properly.

- **Short Repayment Terms:** Borrowers typically have only a few weeks to repay the loan, which can be challenging for those living paycheck to paycheck.

- **Risk of Debt Cycle:** Many borrowers find themselves taking out new loans to pay off existing ones, leading to a cycle of debt that is hard to escape.

#### Alternatives to Payday Loans

If you’re considering payday loans in Mobile, Mobile AL, it’s wise to explore alternative options. Some alternatives include:

- **Credit Unions:** Many credit unions offer small loans with lower interest rates and more flexible repayment terms.

- **Personal Loans:** Traditional banks and online lenders may provide personal loans with better rates and longer repayment periods.

- **Payment Plans:** If you’re facing a specific bill, consider negotiating a payment plan with the service provider to avoid high-interest loans.

#### Conclusion

Payday loans in Mobile, Mobile AL can be a quick solution for urgent financial needs, but they come with significant risks due to their high costs and short repayment terms. It’s essential to weigh the pros and cons carefully and consider alternatives before committing to a payday loan. Always ensure that you have a solid repayment plan in place to avoid falling into a debt trap. If you find yourself in a financial bind, seek advice from financial counselors or explore community resources that may offer assistance.