Unlock Instant Cash: Discover How to Secure Online Loans in Minutes

Guide or Summary:Introduction to Online Loans in MinutesWhat Are Online Loans in Minutes?Benefits of Online Loans in MinutesThe Application Process for Onli……

Guide or Summary:

- Introduction to Online Loans in Minutes

- What Are Online Loans in Minutes?

- Benefits of Online Loans in Minutes

- The Application Process for Online Loans in Minutes

- Tips for Securing Online Loans in Minutes

Introduction to Online Loans in Minutes

In today’s fast-paced world, financial emergencies can arise at any moment. Whether it’s an unexpected car repair, medical bill, or urgent home maintenance, having quick access to funds can make all the difference. This is where online loans in minutes come into play, offering a swift solution to your financial needs. In this guide, we will explore the benefits, application process, and tips for securing online loans efficiently.

What Are Online Loans in Minutes?

Online loans in minutes are short-term financial products that allow borrowers to apply for and receive funds quickly through online platforms. Unlike traditional bank loans that may require lengthy approval processes and extensive paperwork, online loans are designed for speed and convenience. Borrowers can often complete the entire application process from the comfort of their home, with many lenders offering instant approval and same-day funding.

Benefits of Online Loans in Minutes

1. **Fast Approval**: One of the biggest advantages of online loans in minutes is the rapid approval process. Many lenders provide instant decisions, allowing you to know within minutes whether you’ve been approved for the loan.

2. **Convenience**: Applying for a loan online eliminates the need to visit a physical bank or lender. You can complete the application at any time, from anywhere, using your computer or smartphone.

3. **Accessibility**: Online loans are often accessible to a wider range of borrowers, including those with less-than-perfect credit. Many lenders focus on the overall financial situation rather than just credit scores.

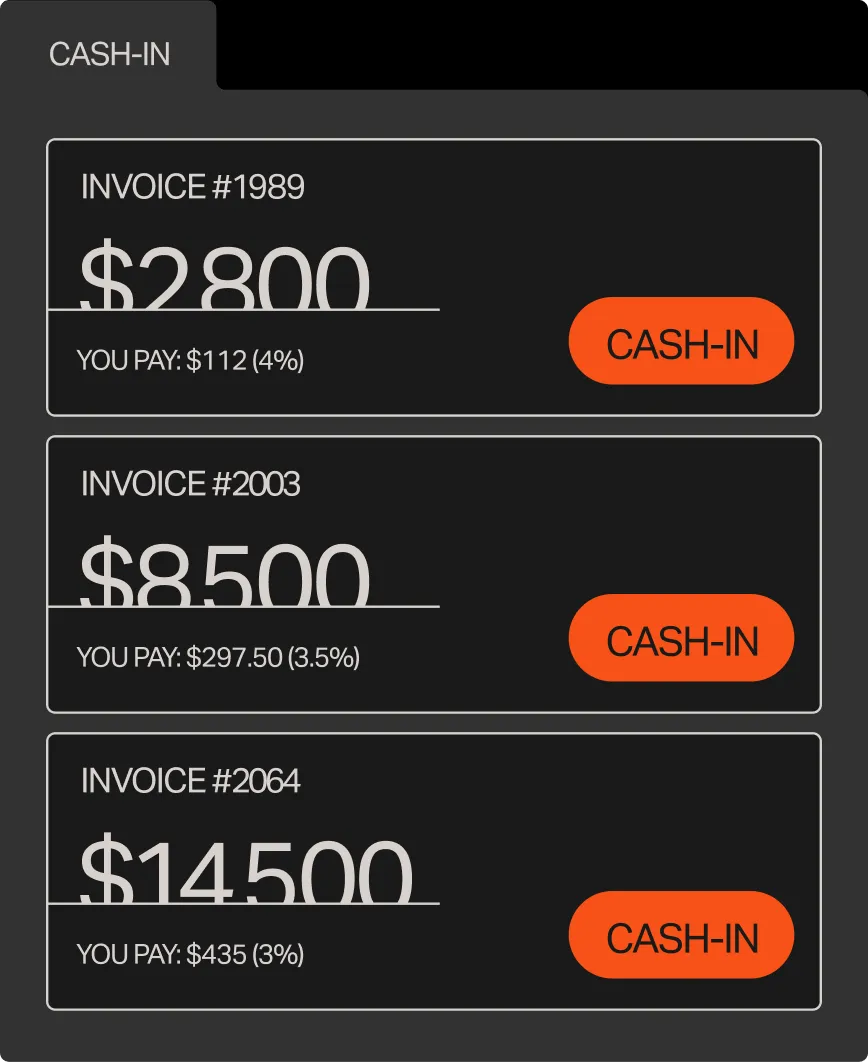

4. **Flexible Loan Amounts**: Depending on your needs, you can typically borrow anywhere from a few hundred to several thousand dollars. This flexibility makes it easier to find a loan that suits your specific financial situation.

5. **Quick Funding**: Once approved, funds can be deposited directly into your bank account within minutes or hours, ensuring you have access to cash when you need it most.

The Application Process for Online Loans in Minutes

Applying for online loans in minutes is a straightforward process. Here’s how it typically works:

1. **Research Lenders**: Start by researching various online lenders to find one that offers loans that meet your needs. Look for reviews and ratings to ensure you choose a reputable lender.

2. **Complete the Application**: Fill out the online application form with your personal and financial information. This may include details about your income, employment, and banking information.

3. **Submit Documentation**: Some lenders may require additional documentation, such as proof of income or identification. Be prepared to upload these documents electronically.

4. **Receive Approval**: After submitting your application, you’ll usually receive a decision within minutes. If approved, the lender will provide you with the loan terms, including interest rates and repayment schedules.

5. **Accept the Loan**: If you agree to the terms, you’ll need to sign the loan agreement electronically. Once completed, the funds will be transferred to your bank account.

Tips for Securing Online Loans in Minutes

- **Know Your Credit Score**: Before applying, check your credit score to understand your borrowing power. This will help you find lenders that are more likely to approve your application.

- **Compare Lenders**: Don’t settle for the first loan offer you receive. Compare interest rates, fees, and repayment terms from multiple lenders to ensure you get the best deal.

- **Read the Fine Print**: Always read the loan agreement carefully. Pay attention to the interest rates, repayment terms, and any potential fees to avoid surprises later on.

- **Only Borrow What You Need**: It can be tempting to borrow more than necessary, but it’s important to only take out what you can afford to repay. This will help you avoid falling into a cycle of debt.

In conclusion, online loans in minutes provide a quick and convenient solution for those facing financial emergencies. With fast approval, easy application processes, and accessible funding, these loans can help you navigate unexpected expenses with ease. By following the tips outlined above and doing your research, you can secure the funds you need without unnecessary stress. Remember, while online loans can be a helpful resource, it’s essential to borrow responsibly and ensure that you can comfortably manage the repayment.