## What is the Average APR on a Car Loan: Unlocking the Secrets to Affordable Financing

When it comes to purchasing a vehicle, understanding the financial implications is key. One of the most important aspects to consider is the interest rate……

When it comes to purchasing a vehicle, understanding the financial implications is key. One of the most important aspects to consider is the interest rate, specifically the Average APR (Annual Percentage Rate) on a car loan. In this article, we will delve into what is the average APR on a car loan, how it affects your monthly payments, and tips on securing the best rates available.

### What is the Average APR on a Car Loan?

The Average APR on a car loan can vary significantly based on several factors, including your credit score, the lender you choose, the type of vehicle, and the loan term. As of 2023, the average APR for new car loans hovers around 5% to 6% for borrowers with good credit. However, those with lower credit scores may face rates exceeding 10%, while exceptional credit scores could secure rates as low as 3%.

### Understanding APR and Its Importance

APR is more than just a number; it represents the total cost of borrowing, including interest and any applicable fees. Understanding APR is crucial because it directly impacts your monthly payments and the overall cost of the vehicle over the life of the loan. A lower APR means you will pay less in interest, which can save you thousands over the duration of the loan.

### Factors Influencing Your Car Loan APR

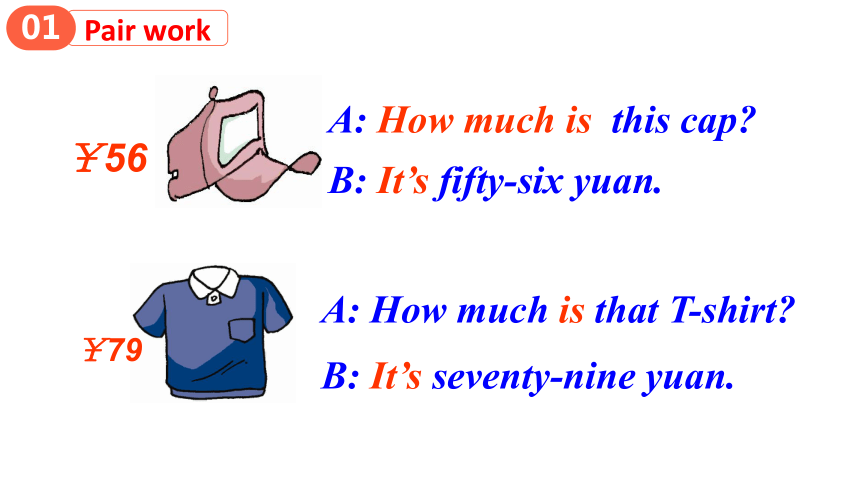

Several factors can influence what is the average APR on a car loan for you personally:

1. **Credit Score**: Lenders use your credit score to assess your risk as a borrower. Higher scores typically lead to lower APRs.

2. **Loan Term**: The length of the loan can impact the APR. Shorter loan terms often have lower rates, while longer terms can result in higher rates.

3. **Down Payment**: A larger down payment can reduce the amount you need to finance, which may lead to a lower APR.

4. **Type of Vehicle**: New cars often come with lower APRs compared to used cars, as they are seen as less risky for lenders.

5. **Lender Type**: Different lenders, such as banks, credit unions, and dealerships, offer varying APRs. It's essential to shop around for the best deal.

### Tips for Securing a Lower APR

1. **Check Your Credit Report**: Before applying for a loan, review your credit report for errors and take steps to improve your score if necessary.

2. **Shop Around**: Don’t settle for the first offer. Compare rates from multiple lenders to find the best APR available.

3. **Consider a Co-Signer**: If your credit is less than stellar, having a co-signer with good credit can help you secure a lower rate.

4. **Negotiate**: Don’t hesitate to negotiate the terms of your loan with lenders. They may be willing to lower the APR to secure your business.

5. **Opt for Automatic Payments**: Some lenders offer a discount on your APR if you set up automatic payments.

### Conclusion

Understanding what is the average APR on a car loan is essential for any potential car buyer. By being informed about the factors that influence APR and taking proactive steps to secure the best rates, you can make a more financially sound decision when purchasing your next vehicle. Remember, a lower APR not only reduces your monthly payments but can also lead to significant savings over the life of the loan. Whether you're eyeing a brand-new model or a reliable used car, being savvy about financing can help you drive away with confidence and peace of mind.