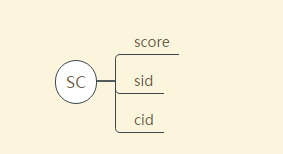

Understanding SC Student Loan Corp: Your Guide to Managing Student Loans Effectively

#### Introduction to SC Student Loan CorpSC Student Loan Corp, or South Carolina Student Loan Corporation, plays a crucial role in providing financial assis……

#### Introduction to SC Student Loan Corp

SC Student Loan Corp, or South Carolina Student Loan Corporation, plays a crucial role in providing financial assistance to students pursuing higher education. The organization is dedicated to helping students manage their loans effectively, ensuring they can focus on their studies without the overwhelming burden of financial stress.

#### The Importance of SC Student Loan Corp

In today's educational landscape, the rising cost of tuition has made student loans an essential resource for many students. SC Student Loan Corp offers various loan programs designed to meet the diverse needs of students in South Carolina. By understanding the services provided by this organization, students can make informed decisions about their financial future.

#### Types of Loans Offered by SC Student Loan Corp

SC Student Loan Corp provides several types of loans, including federal and private student loans. Federal loans typically offer lower interest rates and more flexible repayment options, making them an attractive choice for many students. On the other hand, private loans may be necessary for students who require additional funding beyond what federal loans can cover. The organization also offers specialized loans for specific programs, such as nursing or teaching, to support students in high-demand fields.

#### Loan Repayment Options

One of the most significant concerns for students is how to repay their loans after graduation. SC Student Loan Corp offers various repayment options tailored to different financial situations. These options include standard repayment plans, income-driven repayment plans, and deferment or forbearance options for those facing financial hardship. Understanding these options is essential for students to manage their debt effectively and avoid default.

#### Resources and Support

SC Student Loan Corp is not just a lender; it is also a valuable resource for students navigating the complexities of student loans. The organization provides educational materials, workshops, and one-on-one counseling to help students understand their loans, repayment options, and financial literacy. By taking advantage of these resources, students can empower themselves to make sound financial decisions and develop a comprehensive repayment strategy.

#### Tips for Managing Your Student Loans

Managing student loans can be daunting, but with the right strategies, students can navigate their financial responsibilities more effectively. Here are some tips to consider:

1. **Stay Informed**: Keep up-to-date with your loan balance, interest rates, and repayment options. Knowledge is power when it comes to managing debt.

2. **Create a Budget**: Develop a budget that accounts for your loan payments, living expenses, and savings. This will help you prioritize your finances and avoid unnecessary debt.

3. **Consider Automatic Payments**: Many lenders, including SC Student Loan Corp, offer discounts for setting up automatic payments. This can help you stay on track and save money on interest.

4. **Explore Forgiveness Programs**: If you work in public service or certain high-need fields, you may qualify for loan forgiveness programs. Research these options to see if you are eligible.

5. **Communicate with Your Lender**: If you encounter financial difficulties, reach out to SC Student Loan Corp. They may offer solutions such as deferment or alternative repayment plans.

#### Conclusion

SC Student Loan Corp plays a vital role in supporting students throughout their educational journey. By understanding the types of loans available, repayment options, and resources offered, students can take control of their financial future. With careful planning and informed decision-making, managing student loans can become a manageable part of the overall college experience. Always remember that financial education is key to making the most of your student loans and achieving your academic and career goals.